Which payment gateway should you use for your e-commerce store? A lot of people struggle with this question. After all, payment gateways and online payments in general can be intimidating, especially if it's your first time around the block.

With dozens of online payment options to choose from, it can be a complicated decision. But this is where this guide comes into play. Here, we tell you what to look for in a quality online payment gateway and present five of the top solutions in the market.

In a hurry? Here's our summary of the top payment gateways out there:

Table of contents:

👉 What is a payment gateway?

👉 How does a payment gateway work?

👉 How to pick a payment gateway

👉 Best payment gateways compared

👉 Summary and final recommendation

Let's start with the basics:

What is a payment gateway?

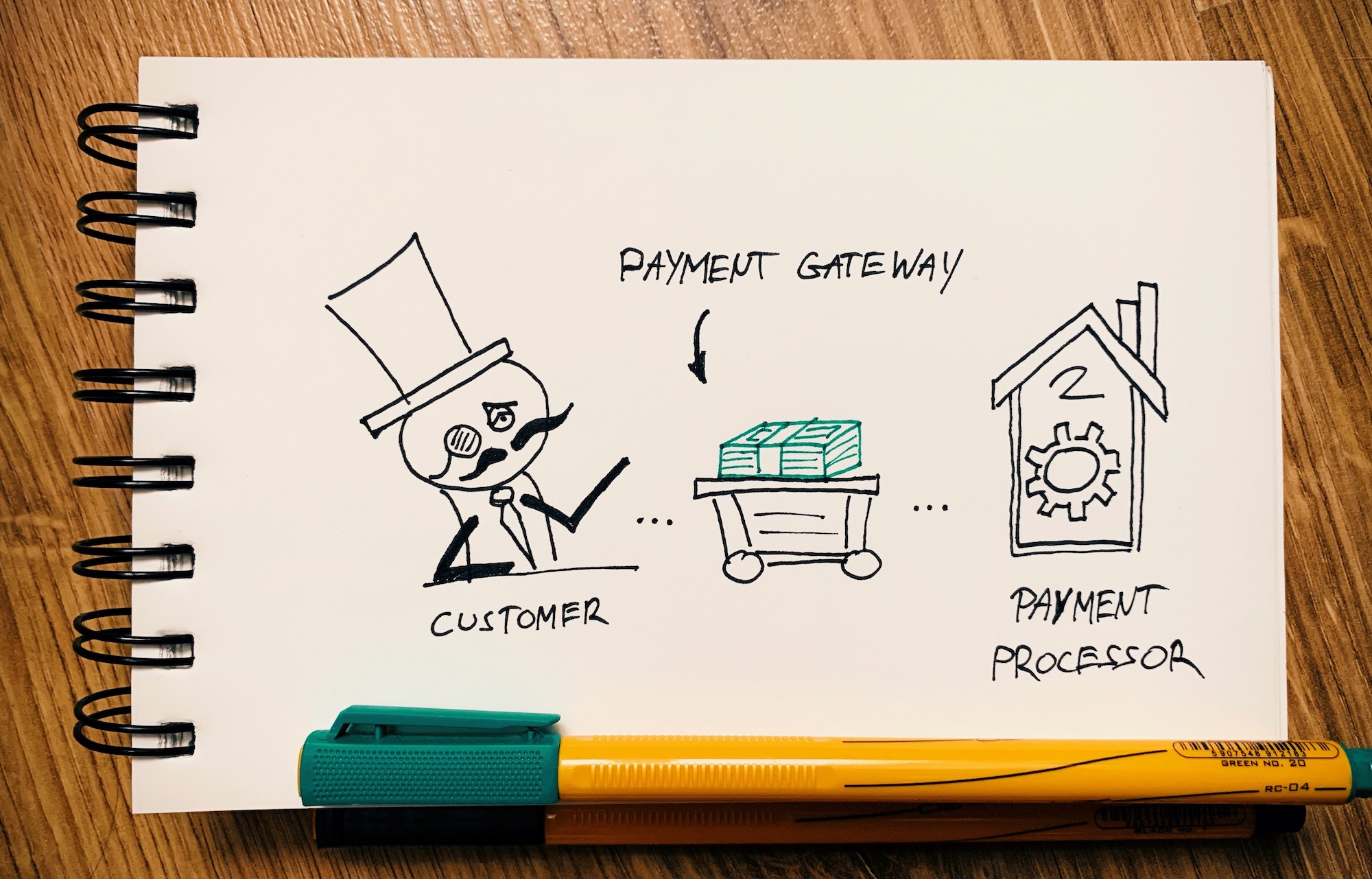

A payment gateway is the middleman between your online store and the payment processor that receives the payment from your customer.

In other words, once a customer enters their payment details on your site, the payment gateway takes care of sending that data securely to the payment processor.

You can think of it like this:

A payment gateway takes care of authorizing the payment and making sure that the data entered is enough to finalize the payment. The gateway protects the details of the credit card by encrypting all sensitive information it holds. This process ensures that personal private details are passed securely between the customer and the merchant.

A payment gateway is part of the “magic” that occurs in the background when a transaction takes place on the web. By sending information securely between the website and the payment processor, and then returning transaction details back to the website, it is a primary component that enables e-commerce stores to function.

If you have an (e-commerce) website and you are interested in accepting credit card payments online, you will need a payment gateway. It is effectively the bridge between your product sales and the customer.

How does a payment gateway work?

The good news is that, as an e-commerce store owner, you don't have to understand how the payment gateway actually works underneath. In practice, all you need to do is pick a gateway and then integrate it with your online store via what's usually a user-friendly setup wizard. After that, it just works and allows you to collect payments from customers.

But just to give you an idea, here's a general look at the steps that take place:

- A customer places an order on your website. They enter the cart, proceed to checkout and fill in their payment details.

- The payment gateway takes the payment information, encrypts it and sends it through a secure channel to the payment processor.

- The customer gets redirected to the payment processor.

- The payment processor takes the customer through the steps to finalize the payment.

- The payment processor verifies if the payment was successful and displays an adequate message to the customer.

- The customer can return to the online store.

What this means in practice is that the payment gateway is only responsible for allowing the customer to communicate with the payment processor. The gateway is just what the name suggests – a “gateway” that takes the customer's personal information through a secure channel to the payment processor.

How to pick a payment gateway

Here's what to look for in a payment gateway:

Five popular payment gateways to consider

Here are the most popular payment gateways in the market, their pros and cons, and the cost involved in working with them:

Note. The payment gateways featured below all check out on the points discussed above, that's why there's only five of them here.

1. Payline

Payline has been in the payment gateway business for a while now. They offer clear fees and a beneficial interchange-plus pricing model.

If you're going to be accepting mainly credit cards, this might be the best solution for you. In this model, you're charged based on each card's associated transaction fees plus the operator's fee.

That being said, you will need a separate merchant account to work with Payline, which does make the setup process more complex and perhaps not as friendly if you're just getting started with a new e-commerce store.

Payline is more of a hands-on payment gateway, meaning that it's up to you to set things up like recurring payments or other non-standard payment schemes. In other words, implementing a specific solution might be more complicated and therefore more fit for established businesses.

Pricing:

- due to the interchange-plus pricing model, you're charged the cost of the specific credit card you're processing + 0.3% of the transaction amount (you can negotiate the fee amount to 0.2% if you have a high enough volume)

- there's also a separate $10 per month fee to keep your account enabled

👉 Read our full Payline review.

2. Stripe

Stripe has been one of the most popular payment gateways in the market for a good couple of years. Clear fee structure, good integration with all major e-commerce systems and easy to use interface have been huge factors in helping Stripe gather a happy customer base.

Stripe is probably the most developer-centered payment gateway out there as well. This might sound intimidating to some, but what it actually means is that you can fine-tune Stripe to serve your business exactly the way you want it.

Stripe lets you handle one-off payments, bill customers on a recurring basis, set up a marketplace, or even handle in-person payments.

Stripe also guarantees transaction security and stores all credit card numbers and transaction details in a secure way (using good AES-256 encryption keys).

Moreover:

- Stripe has PCI DSS Level 1 certification

- Issues SSAE18/SOC 1 type 1 and 2 reports

- Has Money Transmitter Licenses across the US, AFSL in Australia, E-Money License in Europe, and registered MSB in Canada

- Is PSD2 and Strong Customer Authentication (SCA) compliant in the EU

- Works with 135+ currencies

- Currently available in 30+ countries

- Works with a huge number of third-party tools and platforms – read: will work with your e-commerce provider for sure

On top of all that, there's 24×7 support via email, chat and over the phone.

- 2.9% + 30¢ per credit card transaction amount within the US

- +1% when accepting international cards

👉 Read our full Stripe review.

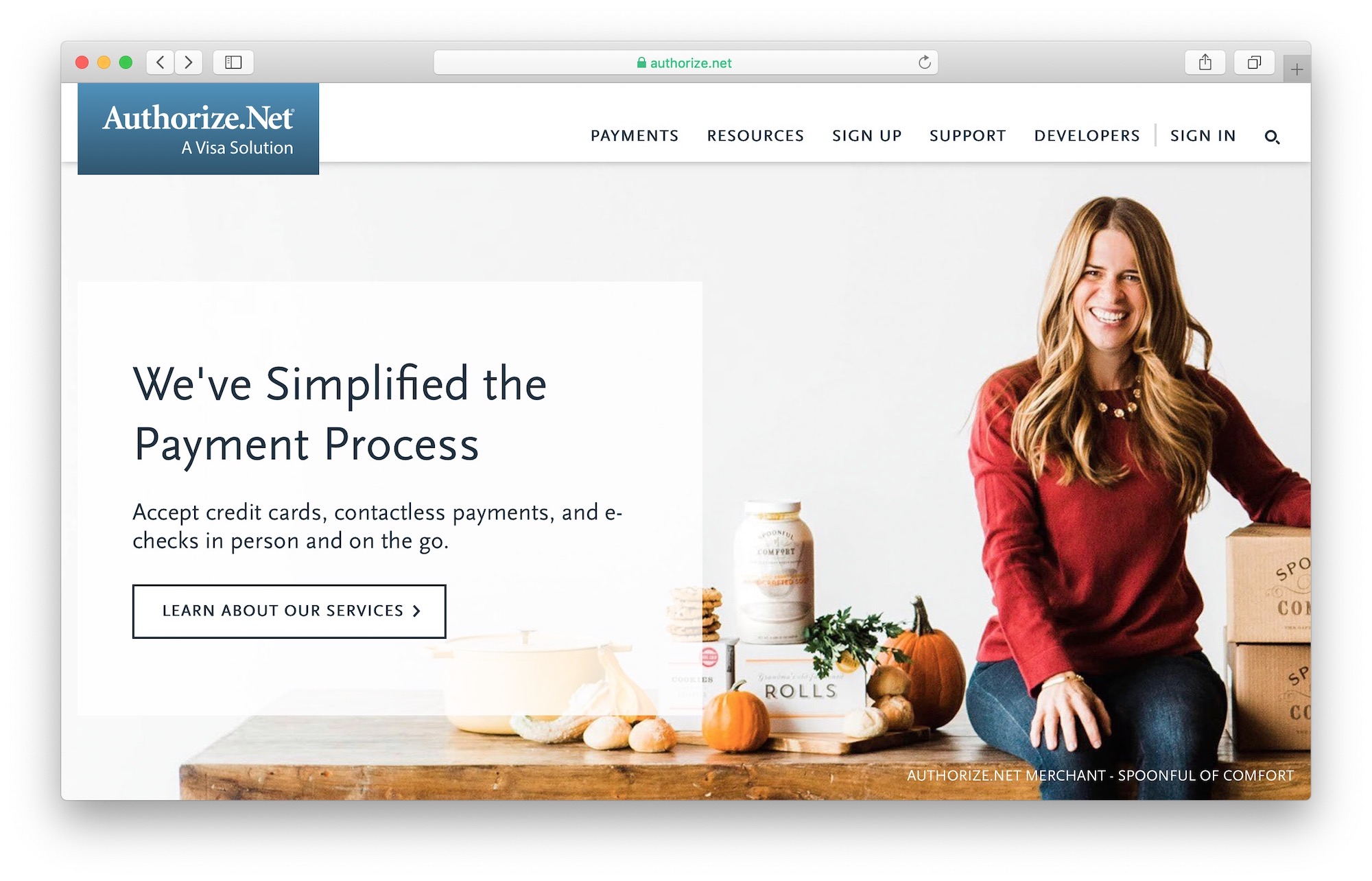

3. Authorize.Net

Authorize.Net is one of the most recognizable and oldest payment gateways operating on the web. They've been around since 1996 and have been making it possible for businesses of any kind to accept payments on the web and in person.

Authorize.Net allows you to accept credit cards, contactless payments, and e-checks.

There's also advanced fraud detection, which can save your business from unauthorized payments or other forms of payment-related troubles.

It's also worth pointing out that Authorize.Net stores your customers' data in a secure way and allows you to tokenize all the sensitive info.

Based on what your business needs, you can use Authorize.Net to issue invoices, set up recurring payments, and use a simplified checkout process.

Pricing:

- All-in-One Option: for businesses that don't have a merchant account; $25 per month and 2.9% + 30¢ per transaction

- Payment Gateway Only: for businesses that already have a merchant account; $25 per month and 10¢ per transaction

- Enterprise Solutions for businesses that process more than $500K per year

👉 Read our full Authorize.Net review.

4. PayPal

PayPal is the most recognized and well-known payment processor / payment solution / payment gateway of them all.

PayPal is indeed much more than just a gateway that business owners can integrate with their e-commerce stores. In fact, many casual users have PayPal accounts of their own and use the service to handle casual payments on the web or even to split a bill with their friends.

All this makes PayPal the must-have payment gateway for your e-commerce store, purely because it's the one solution that guarantees you'll be able to sell your products to everyone.

From a business owner's perspective, there are different flavors of the PayPal offering that you should look into:

- PayPal Payments Standard

- PayPal Express Checkout

- PayPal Payments Pro

The differences between the three may be fine, but they can be significant based on the types of products you're selling.

PayPal Payments Standard and PayPal Express Checkout work very similarly. The only difference is that with Standard, the customer creates an order on your site → customizes it → and then gets redirected to PayPal to make the payment.

With PayPal Express, the customer will be redirected to PayPal to authorize the charge but won't complete the checkout process there. Instead, they will be able to come back to your site, customize the order, and then get charged in the background without leaving your site.

With PayPal Payments Pro, you get to customize the entire checkout process, and the customer remains on your site the entire time. Currently, PayPal Payments Pro is available only in a handful of countries.

Some more important details about PayPal as a payment gateway:

- you don't need a merchant account to use PayPal

- you get advanced fraud protection

- you can issue invoices

- you can withdraw money quickly to a bank account in your local currency

Pricing:

- PayPal Payments Standard: 2.9% + 30¢ per transaction; there are volume discounts if you process a lot of payments

- PayPal Express Checkout: 2.9% + 30¢ per transaction

- PayPal Payments Pro: 2.9% + 30¢ per transaction; plus $30 per month

👉 Read our full PayPal review.

5. 2Checkout

2Checkout has been around since 2006 and now offers services in over 180 countries.

They provide you with a complete solution to process payments online, giving you access to an advanced platform where you can manage your business' finances and e-commerce efforts.

One of the unique things about 2Checkout is that apart from being able to integrate their payment gateway with all popular e-commerce platforms, you also get access to a hosted shopping cart that's been built with all of the best practices in mind and optimized for maximum conversion. This gives you the option to work with 2Checkout alone, without the need for an external e-commerces solution. This can be an attractive option for businesses that don't yet have an e-commerce setup.

Other important details about 2Checkout's offering:

- works in 29 languages and 100 currencies

- localized checkout for supported countries

- integrates with more than 120 e-commerce tools

- allows you to accept all major credit cards and PayPal payments

- the “2Comply” add-on provides advanced tax and VAT handling and compliance

Pricing:

- “2Sell”: easy and simple way to sell globally; 3.5% + 30¢ per transaction

- “2Subscribe”: for subscription businesses; 4.5% + 40¢ per transaction

- “2Monetize”: all-in-one solution to sell digital goods globally; 6% + 50¢ per transaction

This pricing may look like overall more expensive than the other solutions on the list but, particularly with the latter two plans, you get a number of extra features that go above just acting as a simple payment gateway.

👉 Read our full 2Checkout review.

Summary

This has been your first lesson on what a payment gateway is and the top five gateways available in the market.

At the end of the day, each of them will allow you to collect payments from your customers equally effectively. The real difference is in the side features offered and the overall experience of using the gateway and integrating it with your e-commerce store.

Here's a summary table to help you make a decision:

| Payment gateway | Price from | Editor's rating |

|---|---|---|

| Payline | credit card's own fees + 0.3% per transaction + $10 per month | ⭐⭐⭐ |

| Stripe | 2.9% + 30¢ per transaction | ⭐⭐⭐ |

| Authorize.Net | 2.9% + 30¢ per transaction + $25 per month | ⭐⭐ |

| PayPal | 2.9% + 30¢ per transaction | ⭐⭐ |

| 2Checkout | 3.5% + 30¢ per transaction | ⭐⭐ |

Setting these payment gateways aside, there's one more thing you might want to look into before you consider your e-commerce setup complete, and particularly if you're going to be working with multiple currencies. 💱

Basically, the problem with accepting multiple currencies is that you often lose out on various conversion fees when you try to withdraw the funds or process them in general. For this reason, I encourage you to complement your payment gateway(s) with Wise for Business.

Wise is a really innovative financial service. Basically, it provides you with local bank details for the UK, the Euro zone, Australia, and the US (without needing to have a local address). This means that you can request payments like a local no matter where you are. Then, you can withdraw money with low fees, thus minimizing your currency conversion costs.

Wise also works the other way around, meaning that it's your best way to pay invoices and send other payments – to your global suppliers, for example.

👉 Read our Wise review here.

This sums up the topic of payment gateways and how to choose the perfect one. If anything is not clear and you need help deciding, feel free to reach out to us via the comments below.

Comments 34 Responses